High information asymmetry (Petersen and Rajan, 1995) and high uncertainty, as documented in the organisational ecology literature and reflected in the risks linked to their “newness” and “smallness” (Hannan and Freeman, 1989), typically limit a start-up’s access to traditional financing sources. In contrast, VC firms have the capabilities required to deal with these factors and contribute to the management of start-ups.

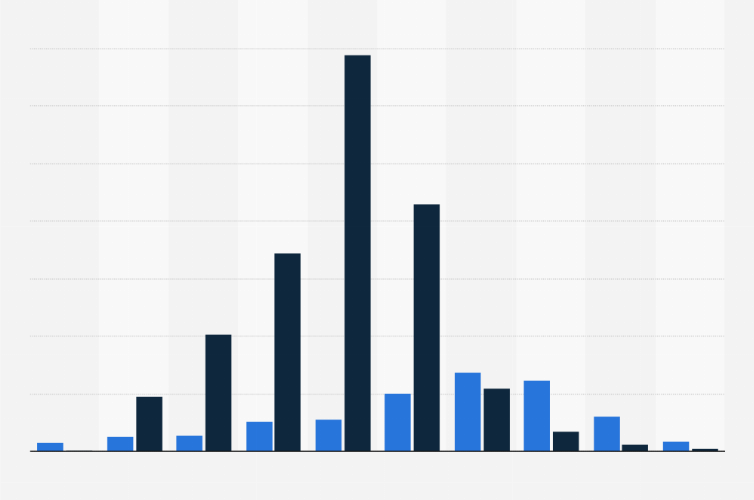

Venture capital (VC) investment in blockchain-related projects has been used as a comparative metric to ICO issuance so as to depict the proliferation of ICOs as a financing vehicle for early stage financing of start-ups relative to the wider VC landscape. Such comparison, although powerful in showcasing the growth in ICO offerings, may be unjustified for a number of reasons.

VC funding can be, and has been in practice, complementary to an ICO offering. VC funds have participated in a number of ICOs offerings either at the pre-ICO stage by taking part in private pre-sales or by funding the expenses of an ICO. For example, in the Filecoin ICO, the issuer (Protocol Labs) raised USD 52 million in a pre-sale, a week before the launch of the public offering to investors including Union Square Ventures and Sequoia Capital venture funds (Wall Street Journal, 2018).

Such complementarity should be sought by start-ups undergoing ICO offerings, in order to take advantage of the non-monetary backing provided by a VC fund. The non-monetary contribution of a VC consists of expertise, industry knowledge, connections and network of contacts, as well as managerial and strategic assistance. VCs provide “coaching” to start- ups and play an active role in the monitoring of a firm’s evolution (Fried et al., 1998). This uniquely caters to the needs of start-ups at the early stage of their development and is missed by start-ups raising funds just through ICOs.

The founding team of a company is of paramount importance in both cases, and the expertise, prior experience and credentials of the founding teams is one of the success factors in both cases. It would, however, be more carefully scrutinised by a VC investor than it is by a retail token-holder, as will be the business plan of the start-up.

Similarly, VC funds undertake a rigorous due diligence process which analyse the management team, the proposed business plan and its viability, among other things. Due diligence in ICO offerings, on the contrary, is not undertaken in a systematic manner.

The undeniable comparative advantage of an ICO offering compared to venture capital financing from the perspective of both the investor and the entrepreneur is liquidity. Tokens issued in ICOs can be traded in secondary markets with immediate liquidity from the day of listing.28

In contrast, VC investments are extremely illiquid and it can take several years for a fund to be able to exit the investment. ICOs give founders the possibility to “cash out” immediately upon raising financing for their company, although as we have discussed in Section 5.2 this may reduce the alignment of interests between the entrepreneur and the investors funding the company.

Recent academic studies on financing of entrepreneurial ventures by ICOs shows that in high volatility29 projects, ICO financing is expected to be more prevalent (if not the preferred source of) financing given that the VC investors would require a higher return to cover for such volatility. In the same vein, ICOs are shown to dominate VC funding for ventures which have a higher proportion of idiosyncratic risk (Chod and Lyandres, 2018).

Naturally, ICOs will be the preferred funding avenue for entrepreneurs as they can receive tokens without pledging any personal funds for the project. Indeed, academic research suggests that ICOs are preferred for projects with a high risk of failure and right-skewed payoff distribution, given that in case of some retention of ICO proceeds by the entrepreneur, the payoff for the entrepreneur is positive even when the project fails (Chod and Lyandres, 2018).

Entrepreneurs may decide to seek financing through an ICO instead of VC as a way to attract a consumer-base and build a network around the project instead of seeking a personal financial reward. While there is a fundamental difference between the two financing methods, the easier network effects may partly explain why ICO funding has overtaken VC funding in recent months. Rather than resorting to an ICO in the absence of other alternatives, companies may seek to fund their companies through token issuance with a view to create and monetise value from network effects.

It should also be noted that, according to market participants, some VC funds consider ICOs as a potential alternative exit option for their traditional VC investments.